House Passes Foster Payer State Amendment To Increase Transparency In Transportation Funding

Washington, DC—Last night, the House of Representatives passed an amendment introduced by Congressman Bill Foster (IL-11) that would take steps to close the Payer State gap by more clearly reporting the distribution of transportation funding.

"Many states are getting out of the Federal Highway Trust Fund several times more than they pay into it, while donor states like Illinois, New York, Florida, New Jersey, California, Michigan, Colorado, and many others, are getting rooked," said Foster. "The Highway Trust Fund has simply become a vehicle for a massive redistribution of wealth from one state to another. Getting to the bottom of this is what my amendment is about."

Foster's amendment would require the Department of Transportation to calculate in each year, how much each state receives from the Highway Trust Fund. The report would also include an accounting of how much revenue each state put into the Highway Trust Fund through both the gas tax and related contributions, and contributions including funds transferred from general revenue.

"This is just one piece of the Payer State problem that is causing Illinois to lose $20-$40 billion a year by paying more than it gets back from the federal government. As long as these aggregate transfers of wealth between the states continue to occur through the federal government, we should at least have a clear picture of what is happening. Transparency in our budget policies is the first of many needed steps to end this irresponsible allocation of resources and close the payer state divide," Foster added.

Earlier this year, Foster introduced the Payer State Transparency Act to create a yearly "Payer State Report" that shows the state-by-state balance of payments to the federal government and federal funding received by states. This amendment would achieve a core piece of the Payer State Transparency Act by developing a report on state tax burdens and federal transportation spending by state.

Foster spoke about the amendment on the House floor. Video of Foster's speech is available here.

Text of Foster's remarks is below:

Thank you Madam Chairman.

I thank the Chairman and Ranking Member for their hard work on this bill.

My amendment is simple – it requires the Department of Transportation to send an annual report to Congress on how much funding each state has received from the Highway Trust Fund, and how much each state has contributed to the Highway Trust Fund, both directly through the gas tax and related fees and taxes, and indirectly through transfers from the general fund.

To understand why this is important, let's step back and ask how it is that we actually decide how much transportation money is spent in each state. The bulk of this funding takes the form of formula grants to the states. With the overall allocations often set by whatever was done in previous years.

This may tell us a lot about Congressional politics in years gone by, but it tells us very little about good public policy. And all of this serves as is a smokescreen which begs the real question: How do we actually allocate our highway spending?

I am a scientist, and I look at facts. And as far as I can tell, here are the facts:

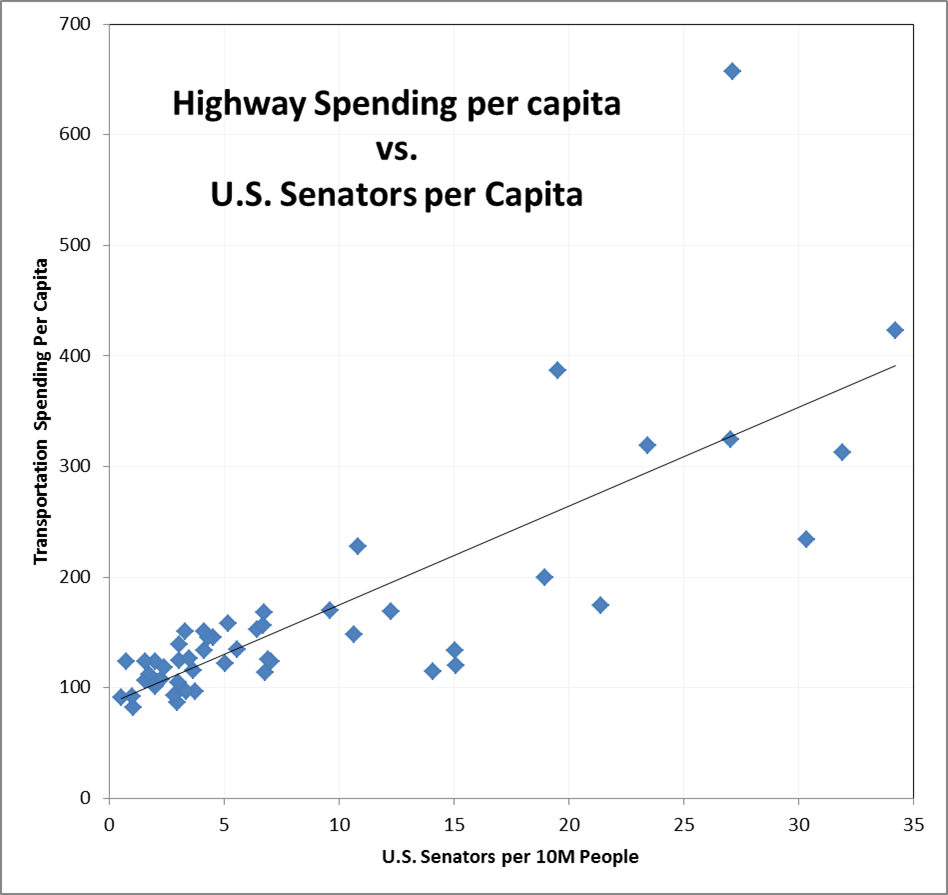

This is a plot that shows the annual per capita spending from the highway trust fund plotted against the number of U.S. Senators per ten million people, which I will explain in a moment. And without objection I would like this included into the record. This plot shows the excellent correlation between the per capita Transportation Trust Fund spending in each state, with the number of Senators per person a state has.

And that says a lot about how broken our transportation trust fund allocations are.

So, how do we allocate transportation spending? If it was calculated per capita, with each American getting roughly the same amount of transportation spending, if this were the case, then transportation money would ultimately follow Americans to whatever States they chose to live in, and could be applied to the best use in each state. Elegant mass transportation systems in urban states, highways through the wilderness in rural states, well-maintained commuter highways in suburban states. And spending in this way would not be a distortion of our economy. But that is not what we do.

In fact, per capita transportation spending varies by more than a factor of seven from state to state, driven by mysterious formulae handed down from generation to generation in Congress.

So in my state of Illinois, we get about $107 per person per year in transportation spending, and I have a hard time explaining to my constituents why citizens of other states should get $200, $400, $600 or more every year in federal highway spending.

The states that are getting rooked like this, generally are the larger states, as can be seen on this plot. In order to rectify this, I filed an amendment to replace complex historical formulae with a simple per capita allotment, which would have benefitted the states here, the states which contain 240 members of the US Congress. I was very disappointed that it was decided that this amendment would not be in order.

Or, perhaps we should divide the Highway Trust Fund by economic productivity and actual highway usage? In this case, each state should take out from the federal highway trust fund the same amount that it paid in taxes. This approach would have an element of basic fairness, and eliminate the economic distortions from massive transfers of wealth between the states. But that is not what we do, either.

Many states are getting out of the Federal Highway Trust Fund several times more money than they paid into it, while other states like Illinois, New York, Florida, New Jersey, California, Michigan, Colorado, and many others, are getting rooked.

And so the Highway Trust Fund has simply become a vehicle for a massive redistribution of wealth from one state to another. Getting to the bottom of this is what my amendment is about.

My amendment would require the Department of Transportation to calculate in each year, how much each state receives from the Highway Trust Fund. The report would also include an accounting of how much revenue each state put into the Highway Trust Fund through both the gas tax and related contributions, AND contributions that were made through funds transferred from general revenue.

While it is relatively easy to figure out how much revenue was collected from each state via the gas tax or personal income tax, determining the same for business taxes is less straightforward. A business, for example, may file its taxes in Delaware, but most of its economic production might occur in a factory in Ohio.

My amendment will require the IRS to assist the department of transportation in this analysis by looking not just at where a company files its taxes, but the state in which those tax dollars are generated. This kind of analysis has sporadically been done by private entities and non-profits, but there has never been a sustained effort by the federal government to do so.

So, I urge my colleagues to join me and to vote yes on this amendment.

Thank you and I reserve the balance of my time.